The Battery Series is a five-part infographic series that explores what investors need to know about modern battery technology, including raw material supply, demand, and future applications.

Explaining the Surging Demand for Lithium-Ion Batteries

In Parts 1 and 2, we examined the evolution of battery technology as well as what batteries can and cannot do. In this part, we will tackle demand in the rechargeable battery market, with a major focus on the rapidly growing lithium-ion segment.

For many decades, lead-acid batteries have been the most important rechargeable batteries in our lives.

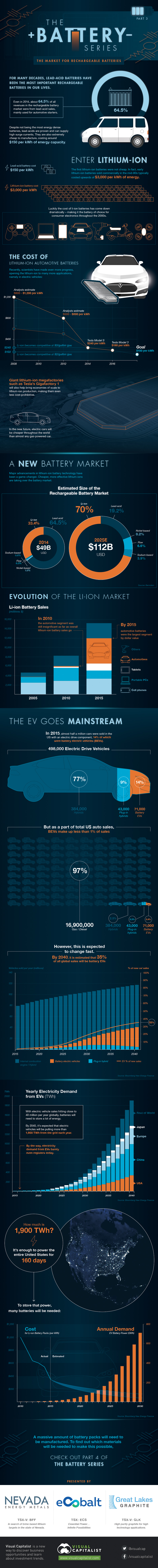

Even in 2014, about 64.5% of all revenues in the rechargeable battery market were from lead-acid sales, mainly to be used for automotive starters.

Why?

Despite not being the most energy dense batteries, lead-acids are proven and can supply high surge currents. They are also extremely cheap to manufacture, costing around $150 per kWh of energy capacity.

ENTER LITHIUM-ION

The first lithium-ions were not cheap. In fact, early batteries produced commercially in the mid-90s typically costed upwards of $3,000 per kWh of energy.

Luckily, the cost of lithium-ion batteries has come down dramatically, making it the battery of choice for consumer electronics throughout the 2000s. And recently, scientists have made even more progress, opening the lithium-ion to many more applications, namely in electric vehicles.

In 2008, analysts estimated that lithium-ion battery packs costed $600-$1,200 per kWh, but this range would drop to $500-800 per kWh over the following four years. Tesla now claims that a Tesla Model S battery cost is $240 per kWh and that the expected cost for a Model 3 is $190 per kWh.

At $240 kWh, lithium-ions become competitive with $3/gallon gas. At $150, they are even competitive with $2 gas.

Giant megafactories such as Tesla’s Gigafactory 1 will also help bring economies of scale to lithium-ion production, making them even less cost-prohibitive. Soon battery packs will cost closer to $100 per kWh, which will make them essentially cheaper than all gas-powered vehicles.

DEMAND FOR LITHIUM-ION BATTERIES

Major advancements in lithium-ion battery technology have been a game-changer. Cheaper, more-effective lithium-ions are now taking over the battery market.

In 2014, lithium-ions made up 33.4% of the rechargeable battery market worldwide, worth $49 billion. By 2025, it is estimated by Bernstein that the rechargeable battery market will more than double in size to $112 billion, while lithium-ion’s market share will more than double to 70.0%.

The key driver? The automotive segment.

In 2010, the automotive sector was a drop in the bucket for lithium-ion battery sales. Five years later, automotive made up more than $5 billion of sales in a sector worth nearly $16 billion.

THE EV GOES MAINSTREAM

In 2015, almost half a million cars were sold in the US with an electric drive component.

14% of these sales were battery electric vehicles (BEVs):

71,000 Battery EVs (14%)

43,000 plug-in hybrids (9%)

384,000 hybrids (77%)

= 498,000 electric drive vehicles

But as a part of total US auto sales, BEVs still made up less than 1% of sales:

71,000 battery EVs (0.4%)

43,000 plug-in hybrids (0.3%)

384,000 hybrids (2.3%)

16,900,000 gas/diesel sales (97%)

However, in the near future, this is expected to change fast. By 2040, approximately 35% of all global sales will be BEVs.

This will put electric vehicle sales at close to 40 million per year globally, meaning a lot of energy will need to be stored by batteries. Bloomberg New Energy Finance expects that at this point, that electric vehicles will be pulling more than 1,900 TWh from the grid each year.

How much is 1,900 TWh? It’s enough to power the entire United States for 160 days.

And to meet this demand for lithium-ion powered vehicles, a massive amount of battery packs will need to be manufactured.